A Pivotal Moment for Canada: Diversify or Continue to Suffer

October 2025

CANADA HAS WHAT THE WORLD NEEDS - THE QUESTION IS, CAN WE DELIVER AND HOW QUICKLY?

Canada’s trade dependence on the United States is once again under the microscope. With new U.S. tariffs reshaping demand, exports in autos, energy, and forestry have fallen sharply, trimming Canada’s trade surplus with the U.S. by nearly 17% this year. Yet, even as traditional sectors weaken, momentum is building elsewhere: exports to the U.K. and China are climbing rapidly, led by surging demand for metals and minerals. These trends mark a structural turning point — one where diversification is not just an option, but an imperative for Canada’s long-term growth and capital resilience.

Key Takeaways this Month:

The Need to Diversify: The U.S. accounts for roughly 75% of Canada’s total exports, exposing Canada to policy risk, pricing pressure, and capital uncertainty. Sustained growth will depend on widening our trade base beyond the U.S. to other global markets.

Global Demand is in our Favour: Global appetite for food, energy, and base materials presents a near-term opportunity for Canada to expand market share and secure new long-term trading partners.

We Have Done It Recently: With exports to the U.K. up 34.7% and China up 9.3%, Canada has proven it can execute on international trade opportunities — the challenge now is accelerating deal-making.

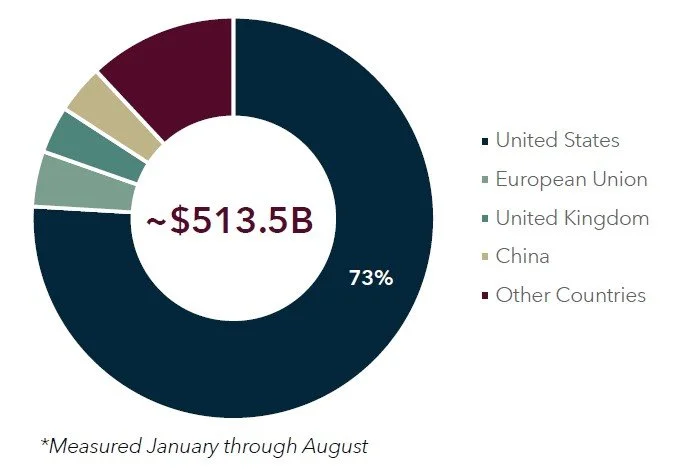

Canadian Exports to End Markets (2024*)

Canadian Exports to End Markets (2025*)

Historically, the U.S. has accounted for 75%+ of total Canadian exports – however, this has shifted downwards to 73% since new tariff policies were introduced

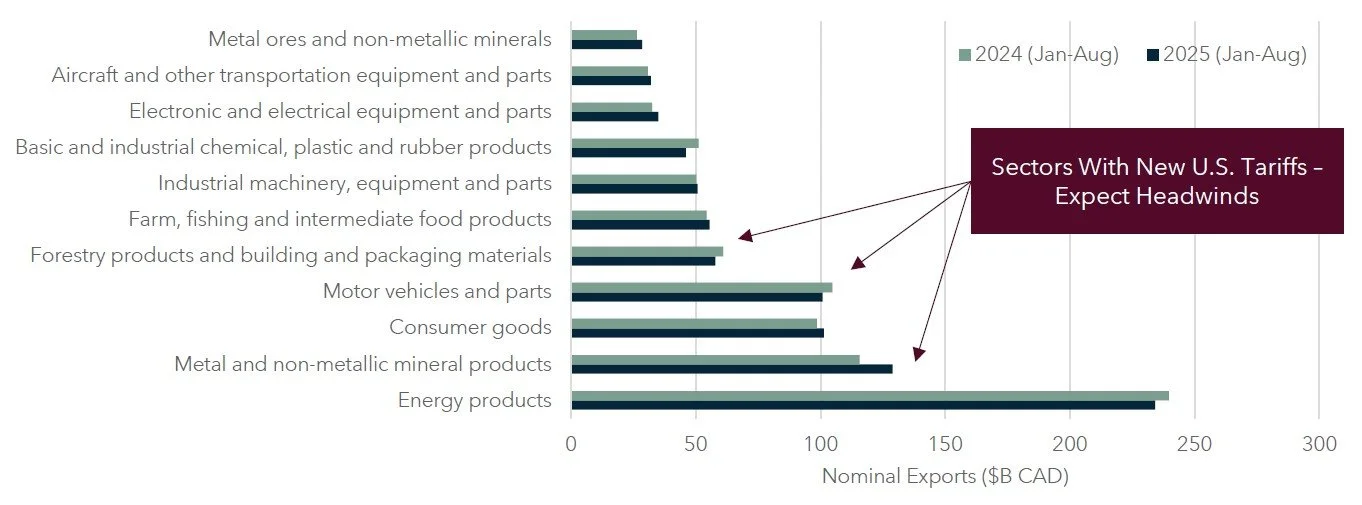

Nominal Canadian Exports to the U.S. by Industry (2025 vs. 2024)

Canadian exports to the U.S. in autos, energy, basic materials, and forestry fell $17.7B YoY, while metals and minerals surged $15.3B, highlighting a shift in sectoral export demand from the U.S.

The U.S. Knows Exactly What They Want: Canadian exports to the U.S. are showing a notable sectoral shift. Autos, energy, basic materials, and forestry fell a combined $17.7B YoY through August, with tariffs driving declines in autos ($3.9B), energy ($5.5B), basic materials ($5.1B), and forestry ($3.1B). Meanwhile, metals and non-metallic minerals surged $13.2B, a 10.8% YoY increase, underscoring rising U.S. demand in these sectors. While largely anticipated, these trends signal a structural change in Canadian export patterns toward metals and minerals.

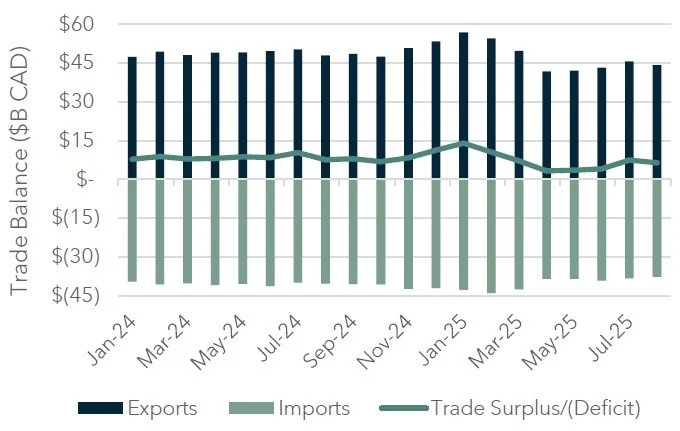

The Canada/U.S. Trade Balance (Jan 2024 - Aug 2025)

Canada’s trade balance with the U.S. has narrowed to $56.4B (Jan – Aug 2025) versus $67.7B (Jan – Aug 2024)

Canada’s Trade Balance With the U.S. Narrowing: Historically, Canada has maintained an asymmetric trade relationship with the U.S., running consistent trade surpluses. Weakening exports in the energy, auto, forestry and basic material sectors have caused this trade balance to narrow in 2025, which has been partially offset by increased exports in metals and minerals. The trade balance between Canada and the U.S. currently stands at $56.4B (Jan – Aug 2025), which is a decline of 16.7% versus the same period in the prior year ($67.7B).

Diversifying Trade: Canada’s Expansion to Other Export Markets

Canadian Exports to End Markets ($B)

Canadian Exports to End Markets (%)

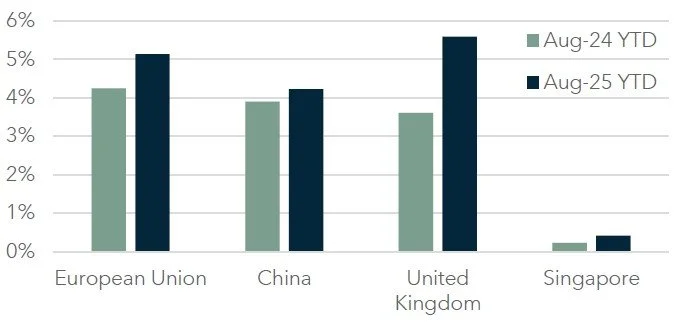

Exports to the U.K., E.U., China, and Singapore rose by a combined $17.7B through August 2025, partially offsetting the $13.0B drop in U.S. export value.

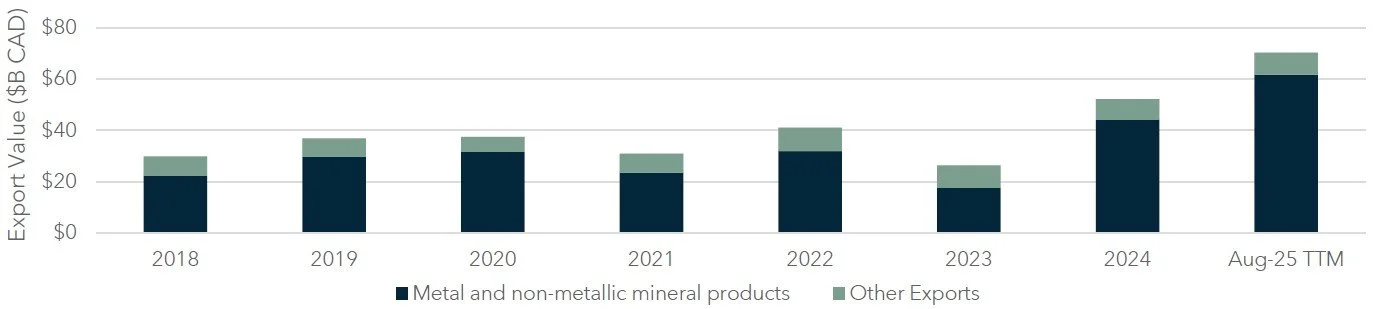

Diversifying Trade: Canada’s Expansion to the U.K.

Diversifying Trade: Canada’s Expansion to China

Most of Canada’s export growth in new markets was driven by increased demand for metal and non-metallic mineral products in the U.K. ($60.6B) and China ($12.5B).

Other Exports Markets are Softening the Blow: Although U.S. export value has declined, Canada is finding momentum in other markets — notably the U.K., where exports are up 34.7% YoY, and China, up 9.3% as of August 2025. Much of this growth stems from surging demand for metals and non-metallic minerals, with exports in the category rising to $236B (from $220B in 2024). The U.K. and China now account for 68% of Canada’s total metal exports, up from 51% a year earlier — underscoring the need for Canada to keep broadening its export base beyond the U.S.

THE CANADIAN ADVANTAGE: WE HAVE WHAT THE WORLD NEEDS, WE JUST NEED TO GIVE IT TO THEM

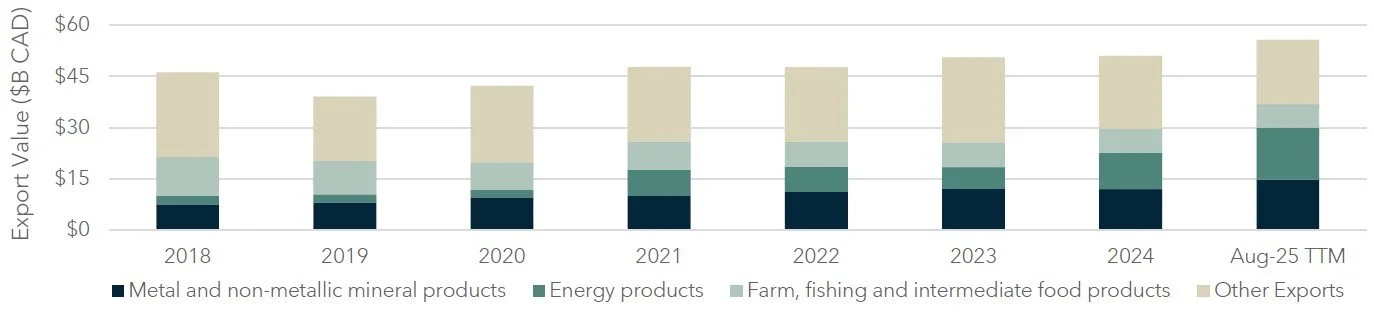

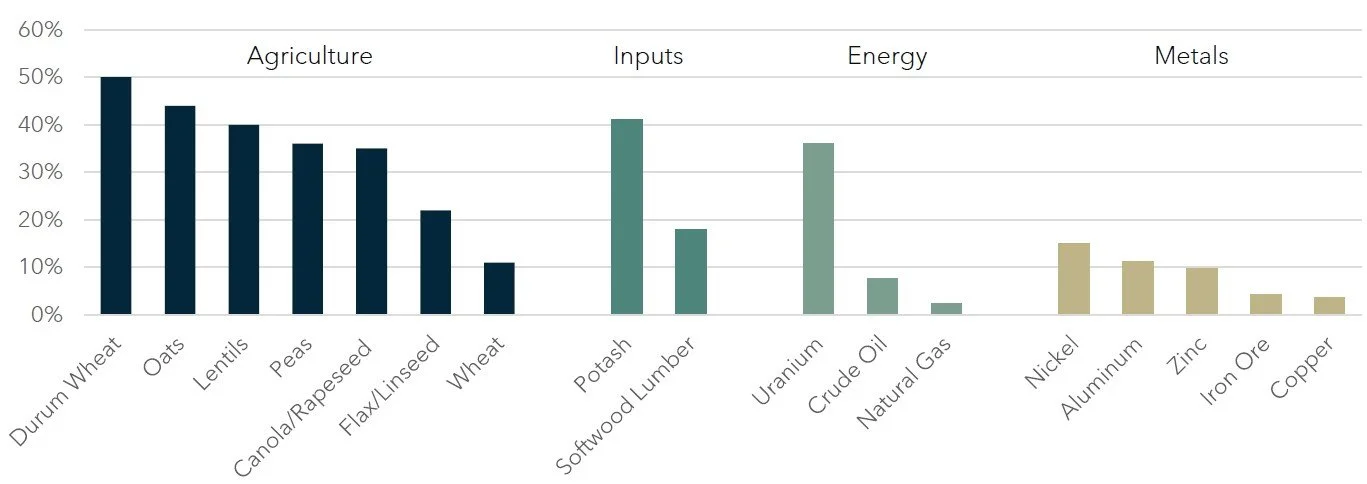

Canada’s % of Global Exports

Canada has ample food, energy, and base materials ready for export and now is the time to make deals with those countries who can provide the goods and capital Canada requires in return.

Energy: The LNG and Crude Catalyst

LNG Canada launched mid-2025, marking Canada’s long-awaited entry into global LNG markets.

The Trans Mountain expansion (operational since May 2024) has re-routed Canadian crude to new destinations: non-U.S. exports surged to ~400,000 barrels per day in early 2025, compared to just 80,000 a year prior.

China is emerging as a key buyer — Vancouver’s crude exports rose 365% in 2025, with roughly 60% of shipments bound for Chinese refiners.

Food: Feeding a Growing World

The global population is estimated to reach 9.8 billion people by 2050, adding nearly 2.8 billion more mouths to feed.

Canada already supplies over $90 billion in agri-food exports annually, anchored by canola, cereals, and oilseeds — but has capacity to grow further.

Rising global food demand, specifically in protein and oilseed consumptions, may position Canada to be a top five global food exporter within the next decade.

Shelter: Building the World’s Foundation

Canada is a leading exporter of softwood lumber, sending roughly 70% of its production abroad (mainly to the U.S., but with growing Asian demand). Forestry products make up ~7.5% of total exports, underscoring their quiet importance.

In addition, Canada’s base metals and mineral exports (~$72 billion in 2023) provide the foundation for global construction and energy transition — from copper and zinc to nickel and uranium.

Sources: Statistics Canada, Department of Finance Canada, The Observatory of Economic Complexity (OEC), The World Bank, USDA, World’s Top Exports, Diamond Willow Advisory.