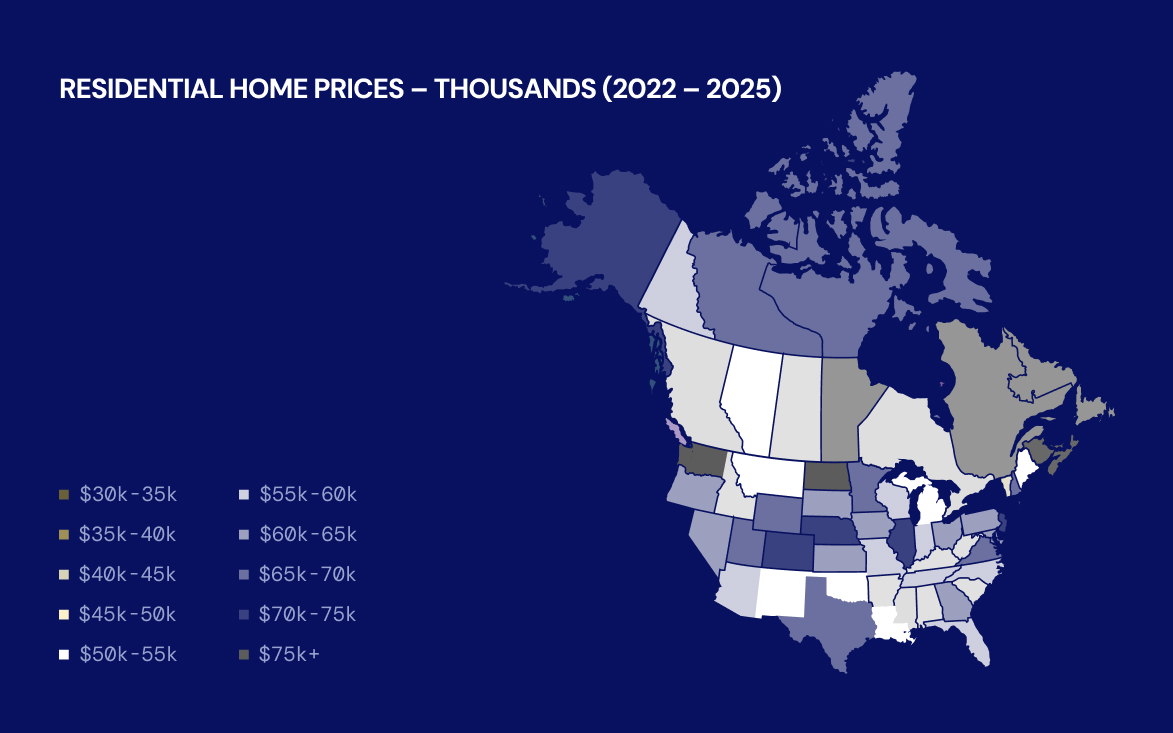

In the latest chapter of the US/Canada relationship, the US has suggested that it would impose a 25% blanket tariff on all Canadian products. This isn’t the first time – in 2018, the US imposed a tariff on Canadian steel and aluminum which directly led to a 12% and 15% decline in export values for those products, respectfully. While many have speculated on the impacts, the overwhelming conclusion is that if a 10% blanket tariff is introduced on Canadian exports, the impact on GDP will eliminate the vast majority of GDP growth in Canada. Note, we have modelled a 10% tariff believing 25% is a negotiating tactic.

Key Takeaways this Month:

The US has accounted for 75%+ of total Canadian exports historically.

The Canadian auto, energy, industrials, and forestry industries are 80%+ reliant on US markets.

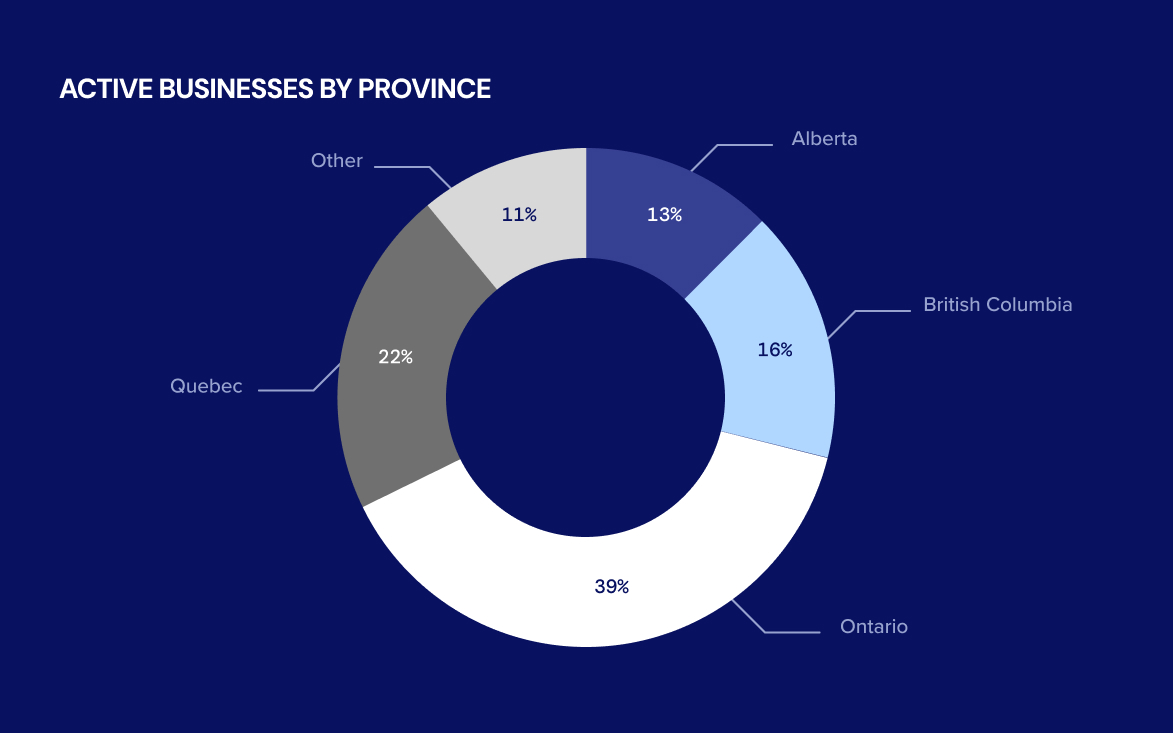

Canadian Industry Has Massive Export Exposure To The US: Approximately 77% of all Canadian exports have a US destination attached to them which, in dollar terms, was $547.9 billion in 2023 or approximately 23% of Canada’s GDP. The Canadian auto and energy industries are particularly exposed to US markets, having exported $82.2 billion and $166.0 billion in 2023 or, equivalently, 95% and 88% of the nominal export value from these industries was shipped to the US in 2023. These figures highlight the critical importance of US markets for these industries and Canada in general.

Canada has a long-term trade surplus with the US of approximately $18 billion per month since January 2022.

At Least Canada Has A Surplus… Right?: Canada has consistently enjoyed a substantial trade surplus with the US, which has often been viewed as ‘strong economic ties between the two countries’. Canada’s September 2024 trailing twelve-month trade surplus with the US reached $107.7 billion. Historically, this surplus has largely been driven by energy exports, particularly Canadian crude oil, which accounted for approximately 23% of all Canadian exports in 2023.

No Energy Tariffs Mute GDP Impact to -0.4%

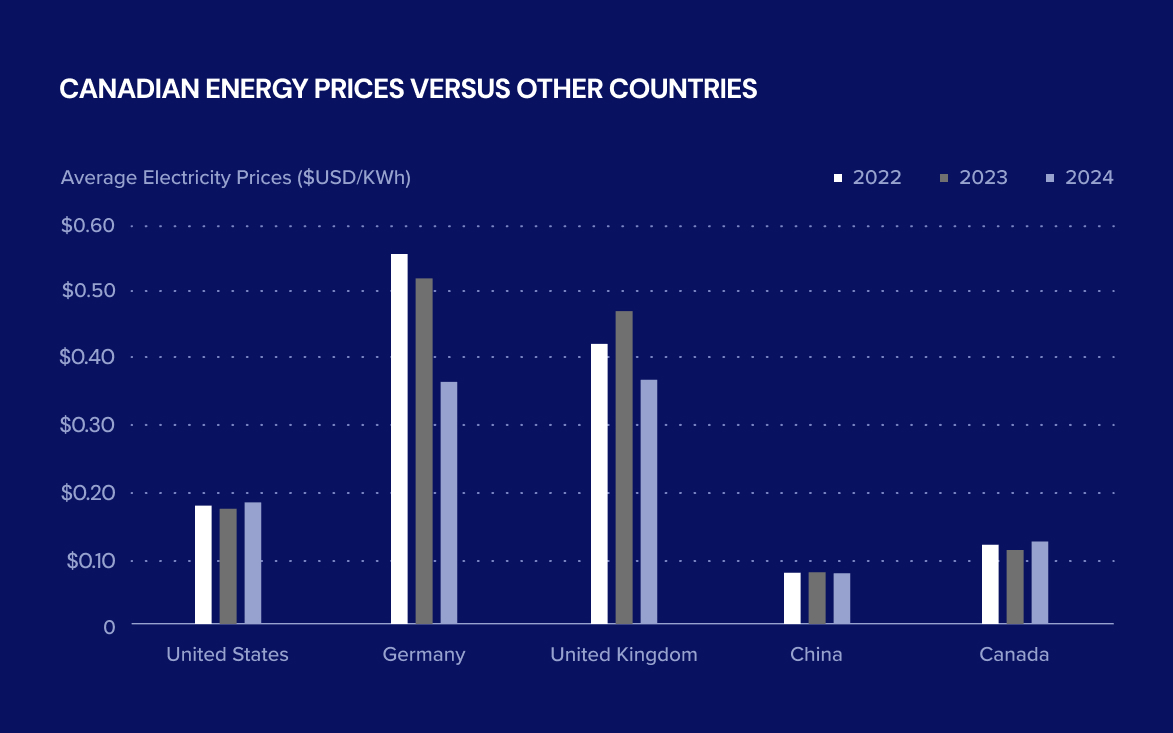

While the US has proposed a blanket 10% tariff on all products from Canada and Mexico, we believe that special consideration should be placed on energy products. Canadian Energy Products accounted for 30% of all Canadian exports in 2023 (or equivalently 52% of all US energy imports). When these products are exempt from the tariff, it leads to a muted impact to GDP (0.4% decline).

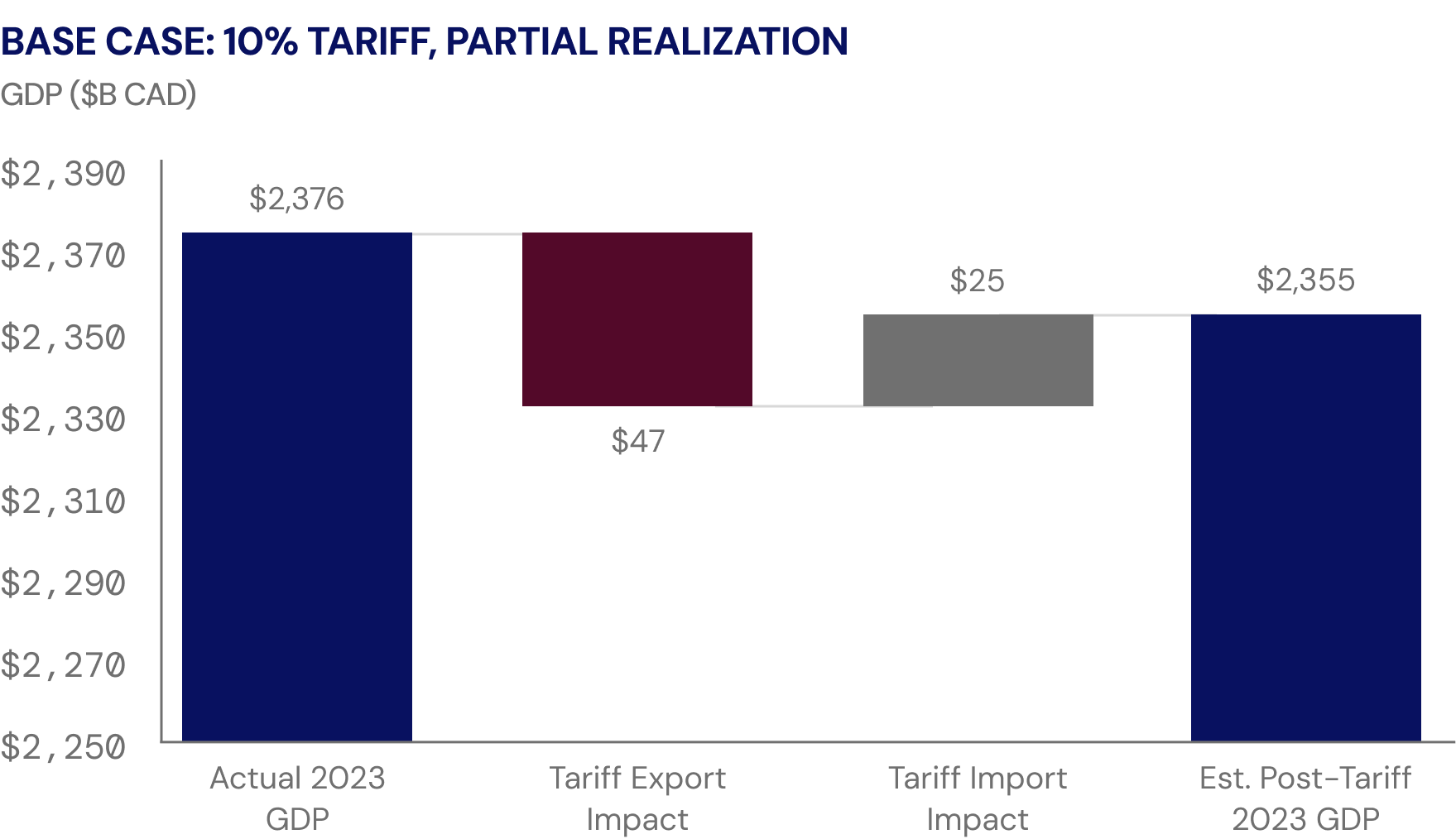

Partial Tariff Realization has a -0.9% GDP Impact

Using the recent steel and aluminium tariffs as our base case, where Canadian exports declined by 13.3% in response to imposed tariffs reflecting a partial recognition of the 10% and 25% tariff in those categories, we forecast that the impact to GDP will be a 0.9% decline. In this instance, Canadian exports to the US will decline by an estimated 6.4% and US imports will decline by an estimated 4% (to reflect retaliatory tariffs).

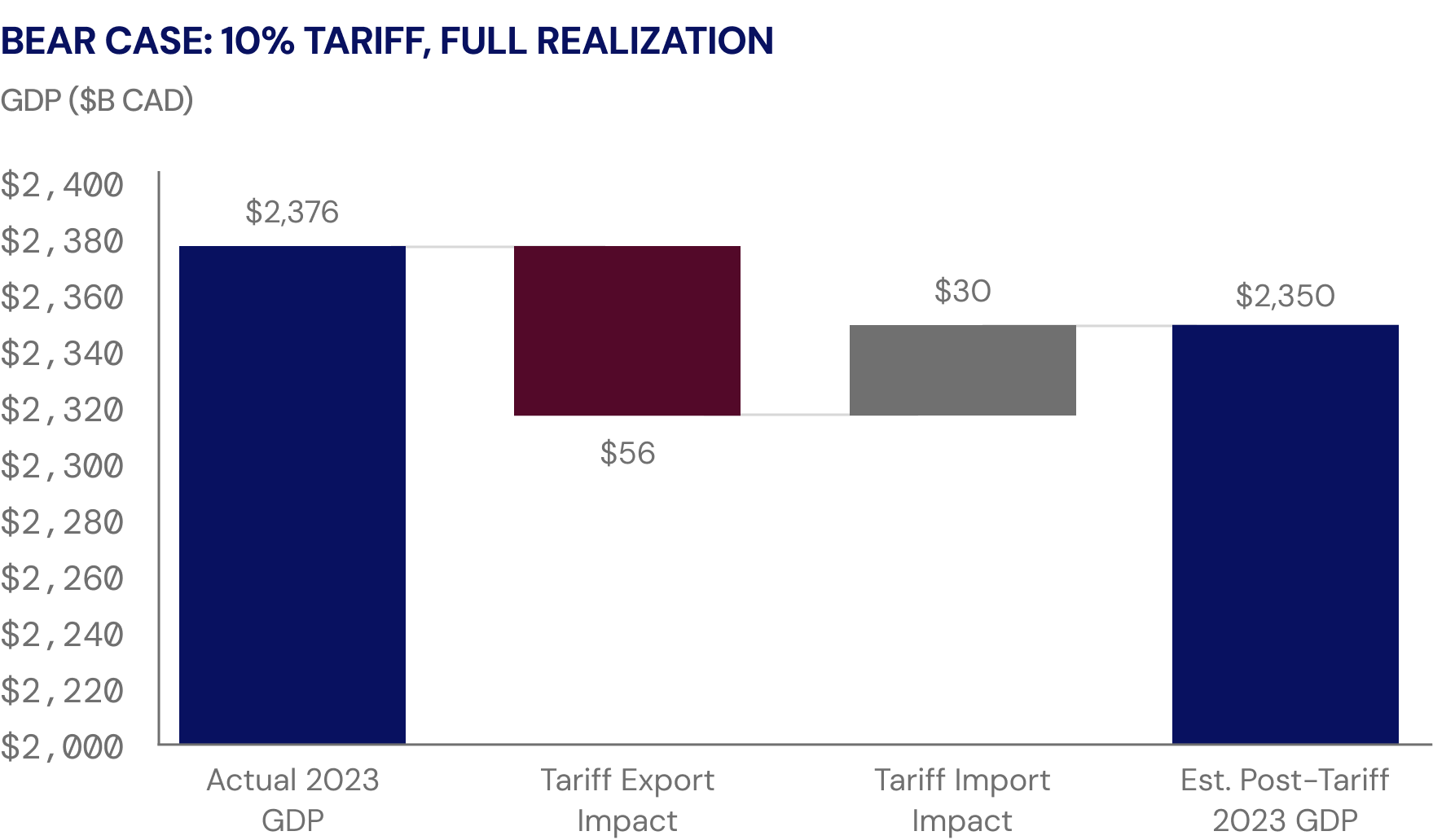

Full Tariff Realization has a -1.1% GDP Impact.

If the proposed 10% blanket tariff is to be fully realized, then we believe that it will lead to an estimated 1.1% decline in Canadian GDP. In this instance, Canadian exports to the US will decline by an estimated 7.7% and US imports will decline by an estimated 5% (again, to reflect retaliatory tariffs). Historically, broad-based tariffs applied to all exports have had a much more muted impact, specifically on Canada.

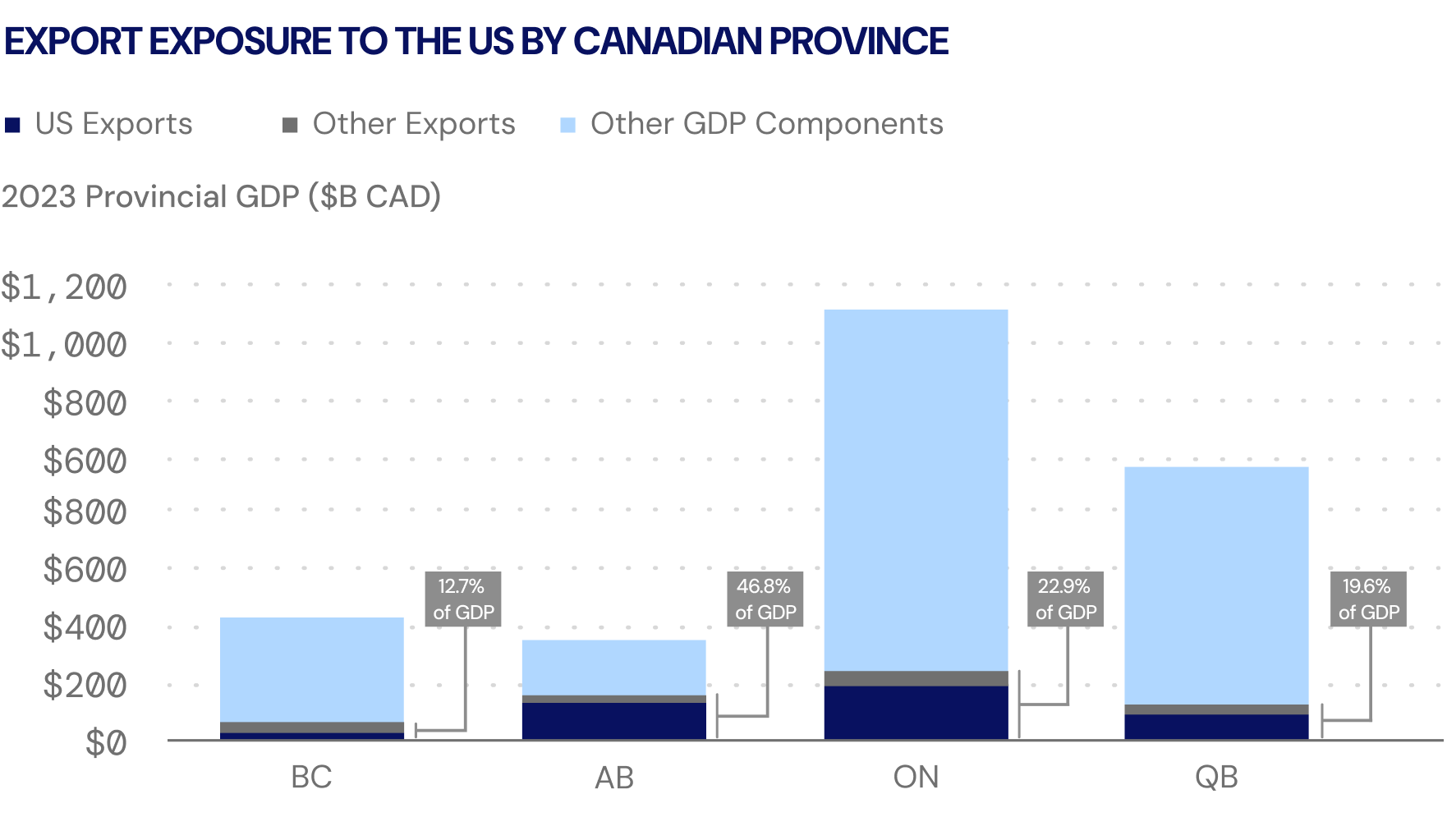

Alberta is heavy exposed to US export markets, which account for 41.8% of the provinces GDP

.png)

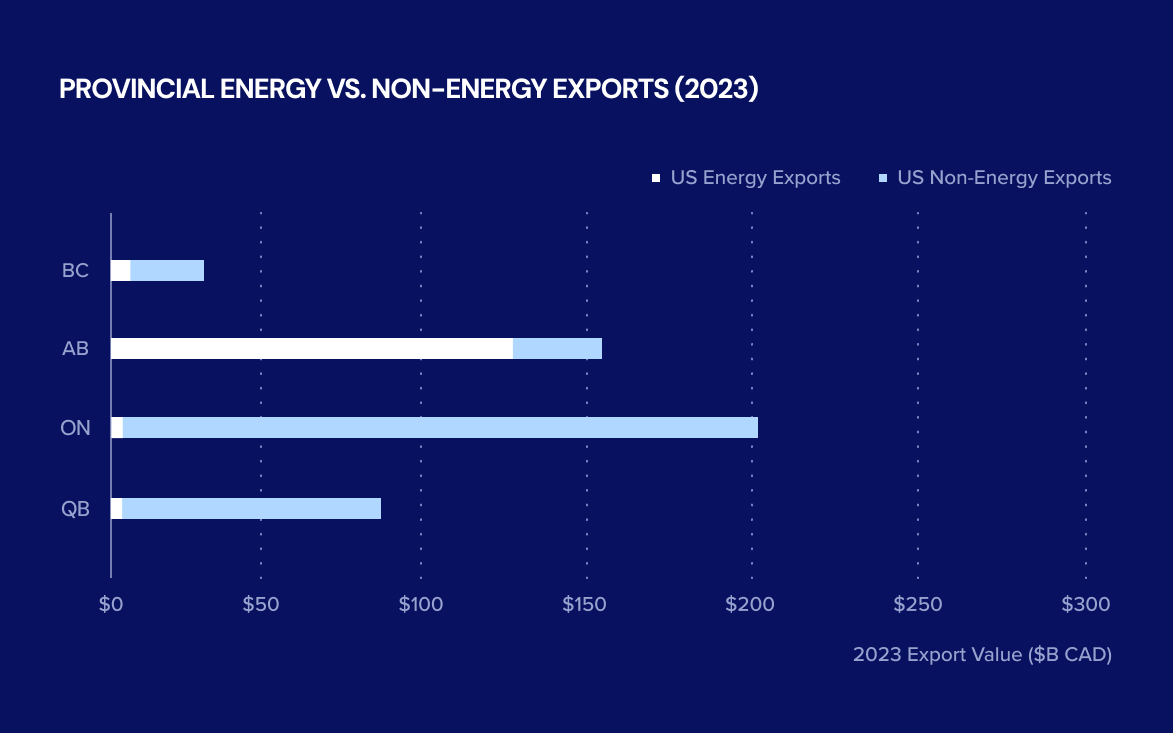

Alberta has Massive US Export Exposure… But Mostly in Energy: On a combined basis, BC, AB, ON and QB accounted for 86.4% of Canada’s 2023 GDP, 84.1% of Canada’s total 2023 exports and 87.4% of Canada’s 2023 exports to the US, meaning any direct impact of proposed US tariffs could have a dramatic impact on Canada as a whole. Unsurprisingly, Alberta has the most US export exposure – in fact, Alberta exported $156 billion of goods and services in 2023 to the US which equated to approximately 41.8% of GDP. Most of these exports were energy products ($127 billion), but it underscores the importance of better understanding of whether of not energy products will be exempt from the proposed US tariffs. If energy products become exempt from the proposed US tariff, we would expect that the impact to AB would be far less pronounced compared to other provinces with a more diversified export base.

Sources: Earnings Reports, Statistics Canada, Diamond Willow Advisory.