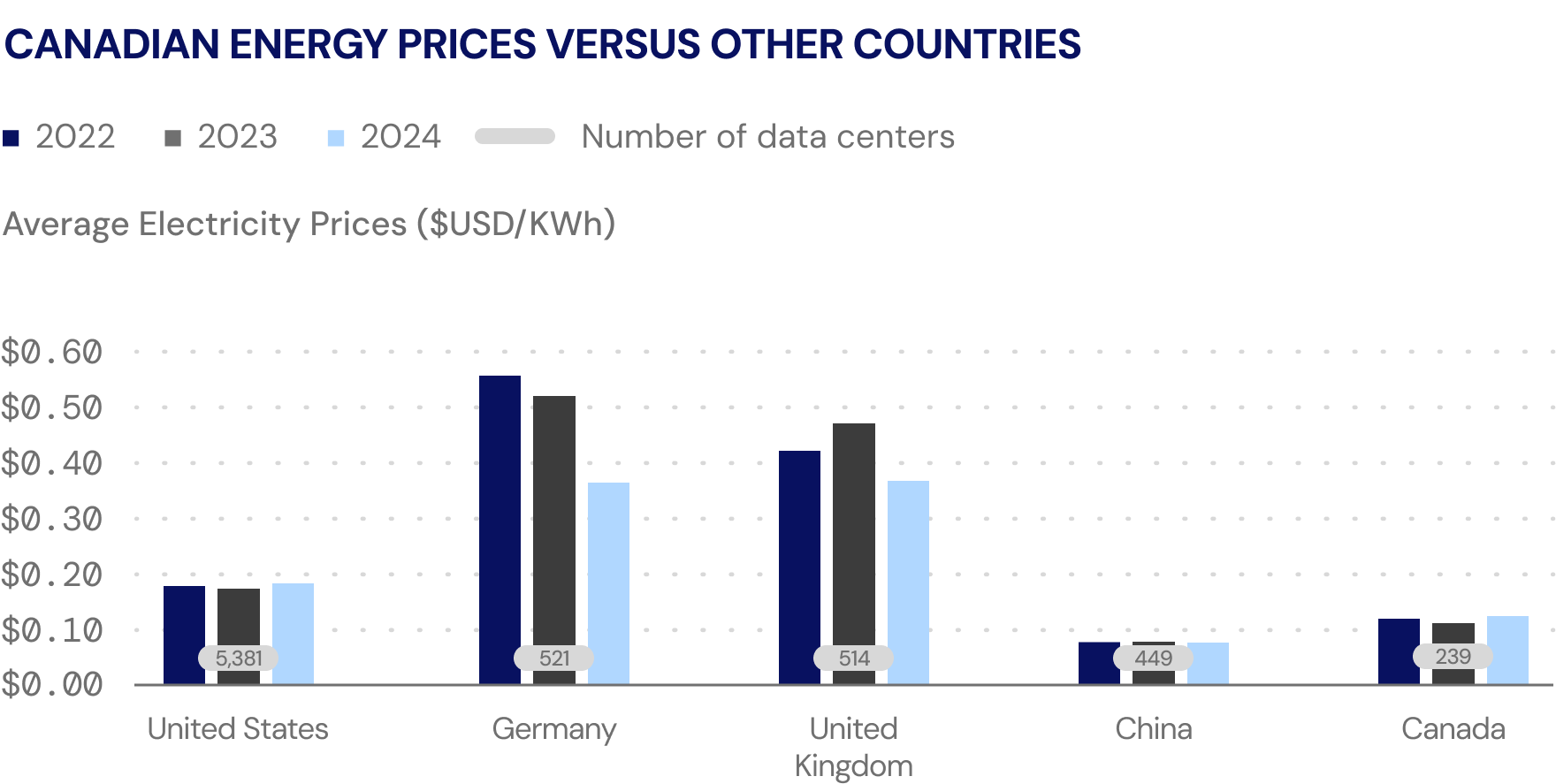

Other than the US election, AI and data centers have been dominating the news with global giants such as Google, Amazon, and Microsoft proposing agreements with nuclear reactors to power their data center aspirations. Canada has potential to become a key player in the global data center market given our ample, low-cost land base, robust and economical power generation capacity, and reliable fiber networks. The catch? How to generate enough reliable power to keep the computer chips humming. Renewables such as wind and solar lack reliability and nuclear has long lead times, meaning natural gas demand (particularly in the western provinces and in the U.S.) could be in for a rebound as the growing data center market’s natural power supply solution in the medium term.

Key Takeaways this Month:

Power demand estimates across the globe are rising thanks to the increasing demand of AI computing.

Data centers require a highly stable power source making renewables an unlikely solution.

Canada currently has 239 operating data centers, but that figure is expected to increase exponentially.

Data center growth is expected but AI will be the growth driver at an estimated 25% 5-year CAGR.

The Data Center Revolution: Canada currently houses 239 operational data centers which consume an estimated 1% of Canada’s total power output (or, equivalently, approximately 735 MW). However, agencies such as the IEA are projecting that data center demand could increase by 150% by 2028 due to the rapid growth in artificial intelligence and demand for computing – and Canada is expected to follow the trend. For example, the Alberta Electricity System Operator has recently announced that six proposed data center applications are in queue to connect to the electric grid (adding an estimated 5,500 MW of power demand or ~40% of current consumption).

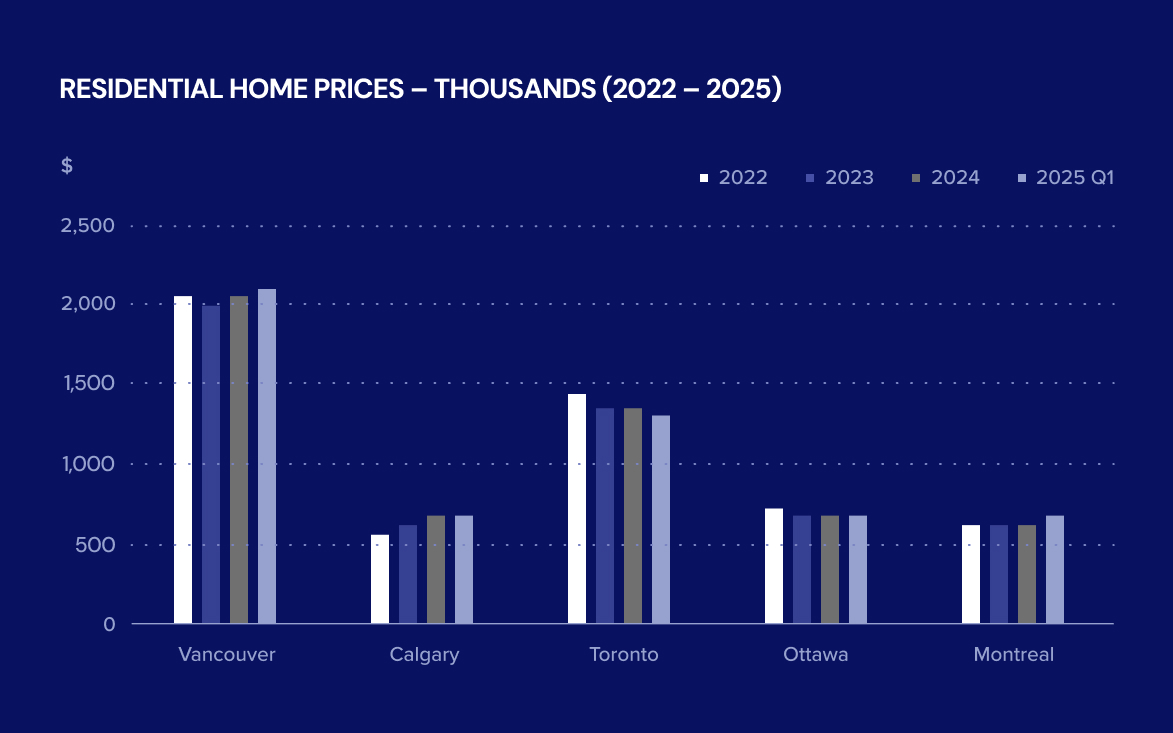

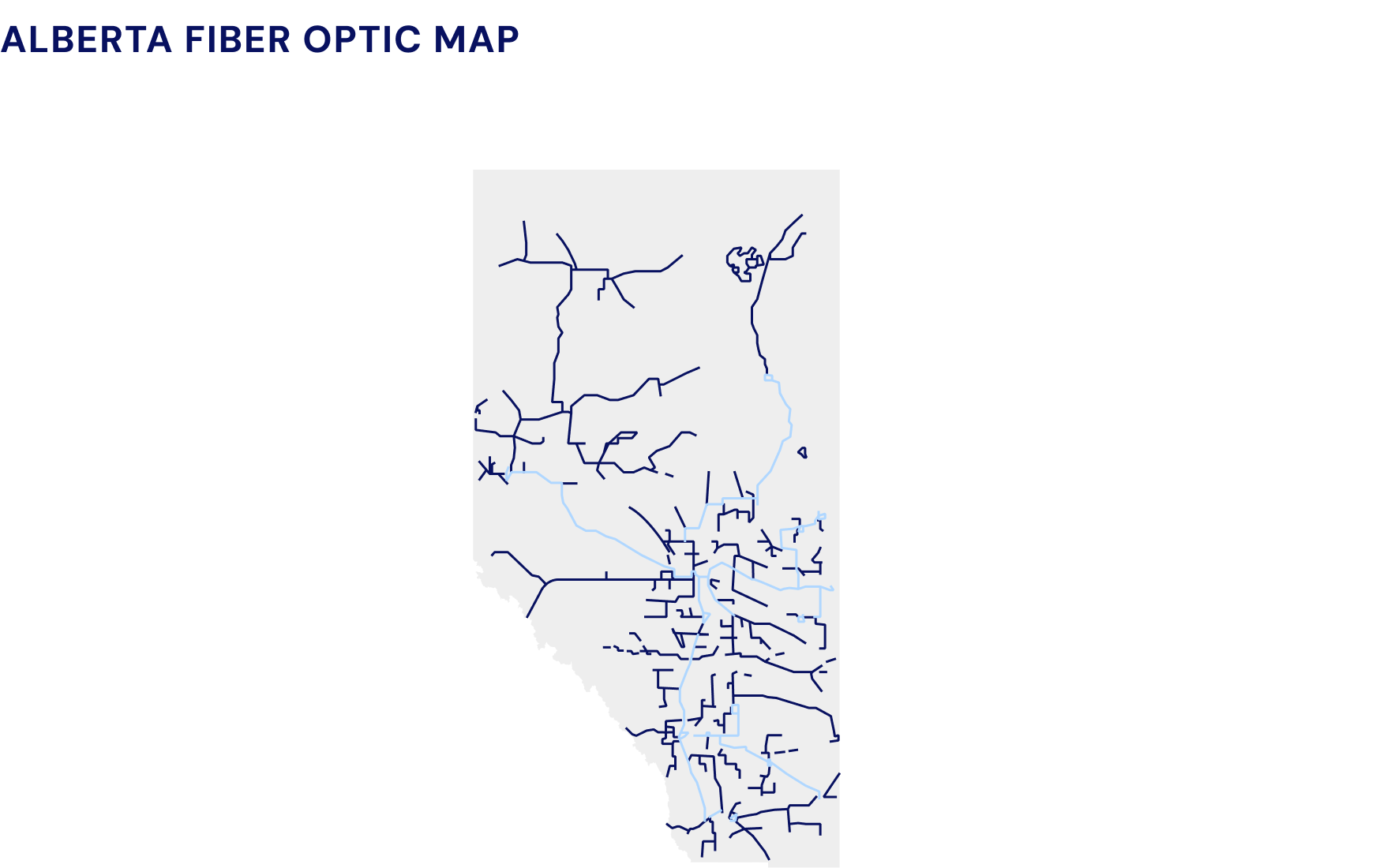

Canada is particularly attractive for data center investment given low electricity costs, abundance of land, and readily available fiber optic network.

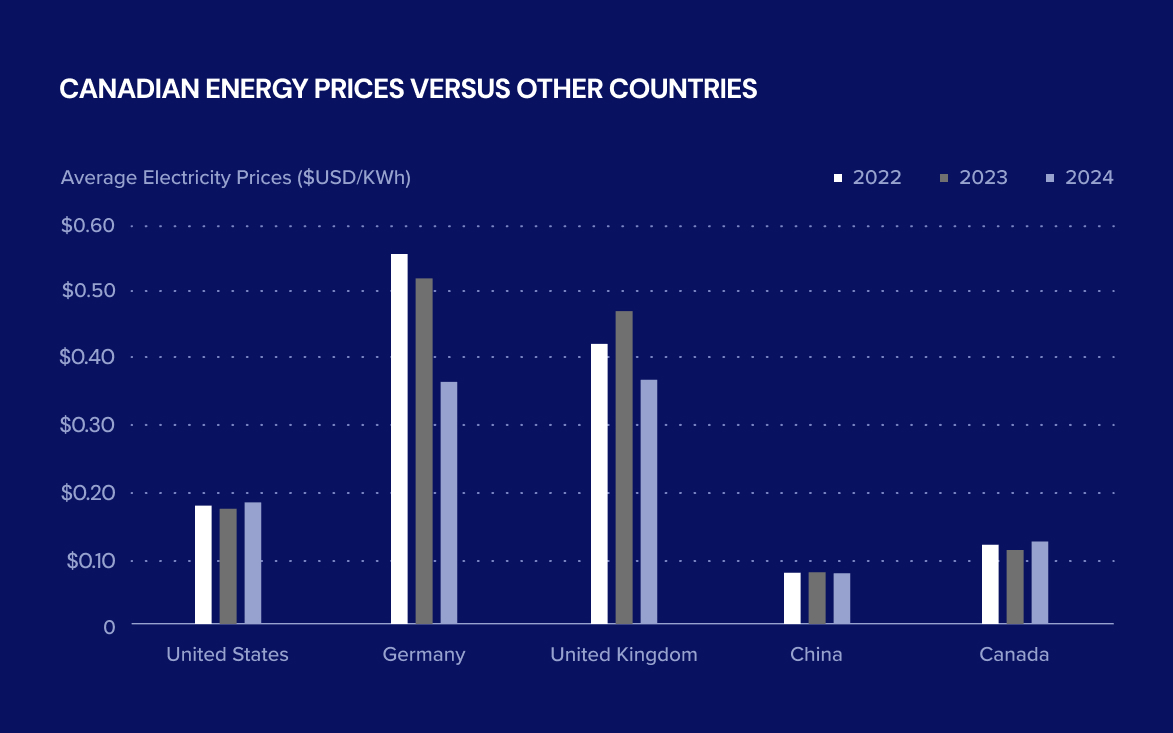

Why Canada, Why Now?: Canada is a particularly attractive investment for data center providers given: (1) low electricity costs, (2) abundance of land and (3) readily available fiber optic network. Compared to the top 10 data center locations in the world, Canada’s electricity prices are, on average, 27% cheaper. But the question data centers will look to answer – is that power reliable?

.png)

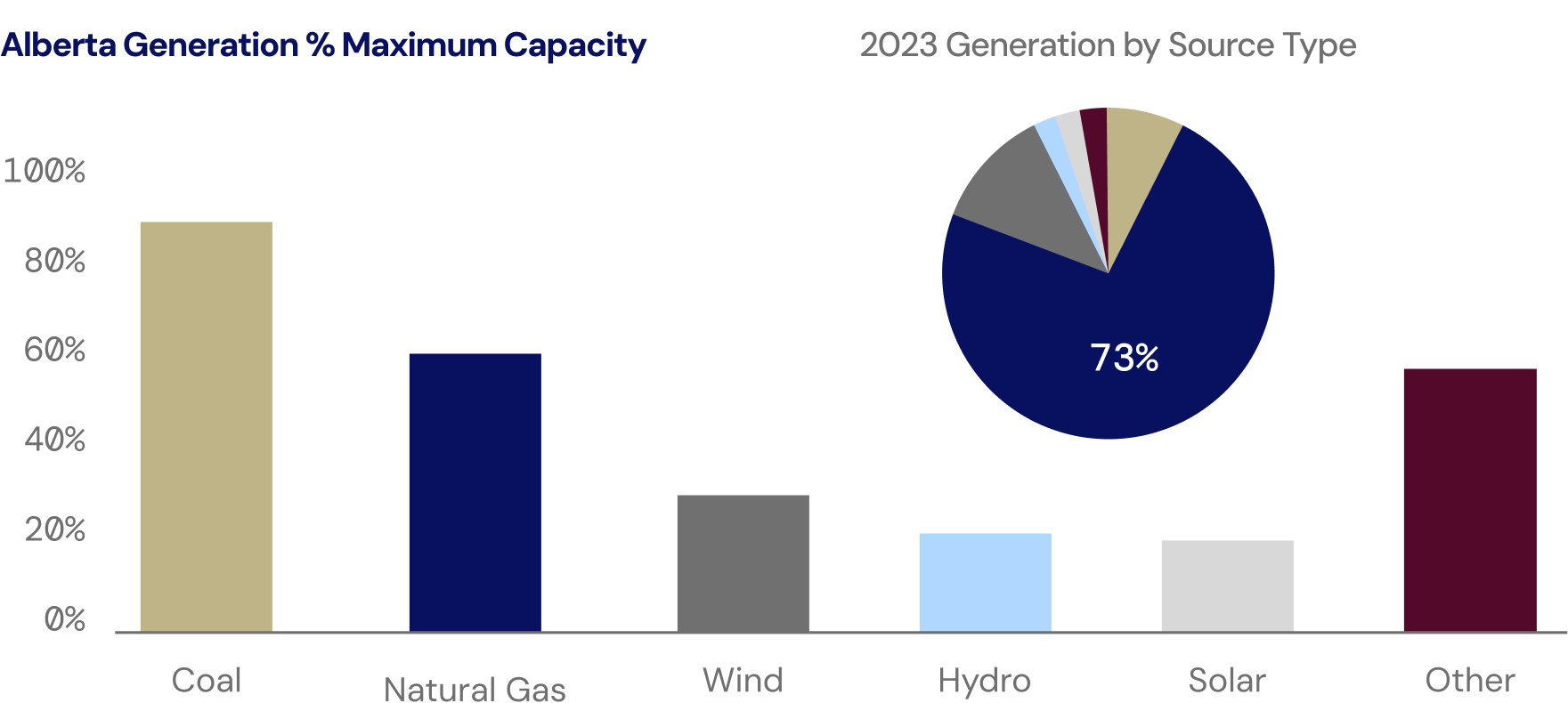

Wind and solar have been the largest growing sources of power over the last 10 years.

Canada Power Supply is Going Green(er): Wind and Solar have gained the most market share over the last ten years but given the demand for consistent and reliable power generation, we are skeptical this is a long-term solution to the planet’s growing power needs. Canadian provinces’ use what resources they have available, with the quickest to market being natural gas driven by Alberta and NE BC. Nuclear could be the next biggest non-carbon growth engine but the lead times are long, and AI is growing rapidly so we expect natural gas to dominate in the next 5 – 10 years.

.png)

Current data center proposals could add an additional 5,500 MW of demand to the Alberta power market - this alone would represent ~40% of Alberta’s current natural gas generating capacity - the upside is potentially much higher.

Alberta Capacity for Data Centers Exists: Alberta’s open market uniquely positions the province as a top contender for data center expansion in Canada, however the question remains as to how these data centers will be powered. Data centers require uninterrupted and high-quality power, making nuclear an ideal fit longer term and natural gas a logical medium-term solution. Although this new demand would be phased in gradually, an additional 5,500 MW of power demand would still account for nearly 40% of Alberta’s current natural gas generating capacity. It appears that Alberta may follow the US trend of “bring your own power” in order to avoid potential grid shortages. Regardless, natural gas demand fundamentals could be in for a strong rebound in the coming years.

Sources: AESO, Government of Alberta, Quant AiQ, CER, Statistica, GlobalX, World Population Review, GlobalData, Diamond Willow Advisory.